Basically, the cheques are of two types i.e. Open and Crossed cheques. A cheque which can be converted into cash on its presentment on any counter of the bank is known as an open cheque. These types of cheques bear a great risk in cases where the party in possession of the cheque loses it. In such cases, the founder of the cheque can redeem that on any cash counter of the bank and encash it.

Hence, in order to curb these situations, certain features in accordance with cheques are recognized by the banking system. Crossing of the cheque is one such feature which ensures safety of cheque holder and its money. A crossed cheque is one in which, two parallel lines on the top-left corner of the cheque are marked along with writing some particular words within those lines. The payment through these cheques can be drawn only by a banker and thus, are a safer mode of transaction.

The crossing compels the holder to present the cheque through a “quarter of known respectability and credit” and affords security and protection to the owner of the cheque, as the cheque is payable only through a banker.

Types of crossing

There are 4 types of crossing:

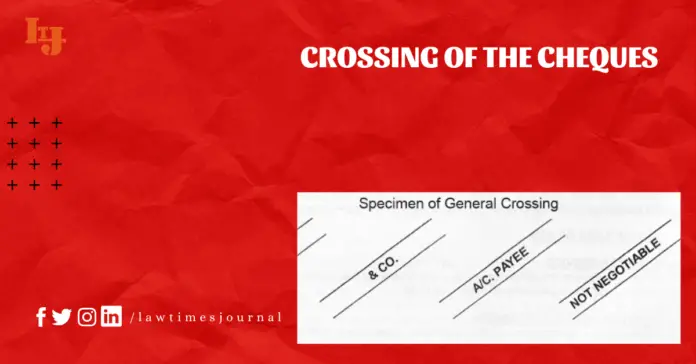

General Crossing –

It refers to the two parallel lines either with or without the words:

1. and company

2. & Co.

3. Not Negotiable

4. Not Negotiable and Co.

5. N/N & Co.

Section- 126 of the Negotiable Instruments Act, 1881 talks about the general crossing of cheques. It explicitly states that “Where a cheque is crossed generally, the banker on whom it is drawn shall not pay it otherwise than to a banker.”

Special Crossing –

It refers to the two parallel lines with the name of the bank written between them with/without the words ‘not negotiable’. These cheques can be paid by the banker on whom it is drawn to the banker on whom it is crossed.

Section- 126, Para-2 of the Negotiable Instruments Act explains the concept of special crossing of cheques. For e.g.-

1. Bank of India written between the two parallel lines.

2. Bank of India written between the two parallel lines along with the words Not Negotiable

3. Bank of India written between the two parallel lines along with the words for A/C of Payee

All these come under the category of special crossing of the cheques.

Restrictive Crossing –

In this type of crossing, the words A/C payee are added to the general/special crossing. A/C Payee means that the amount has to be deposited in the bank account of the payee by the collecting bank. This adds another safety feature to the cheques because in case of a wrong transfer by the banker, he will be liable at the first hand to the true owner and will be considered as a negligence.

These cheques are negotiable in nature.[1]

Not Negotiable Crossing –

If a cheque is crossed by writing not-negotiable in the two parallel lines, it is known as a not-negotiable crossing. It simply means that the transferee holds a better title than the transferor.

Parties in crossing of a cheque

The crossing of the cheque can be done by three parties which are as follows; the drawer, the holder and the banker. The drawer of the cheque has the power to cross a cheque in both ways i.e. general as well as special crossing.

Whereas, the holder and the banker can cross the cheque only under certain circumstances such as where a cheque has been crossed generally by the drawer, the holder can cross it specially.

Similarly, when a cheque has been crossed generally or especially by the drawer, the holder can further add the words not negotiable to it.

Frequently Asked Questions

Can a Special Crossing be converted into a General Crossing?

No, a special crossing cannot be converted into a general crossing until and unless the drawer gives its permission by his/her signature. Although, the opposite of this is possible i.e., a general crossing can be converted into a special crossing.

What do you mean by double crossing of the cheque?

Whenever the second banker acts as an agent to the first collecting banker, it is shown on the cheque by double crossing it. It is basically a type of special crossing which is done in the case where banker does not have a branch in the bank which is acting as a drawer.

What is meant by Marking of Cheques?

Marking of the cheques is generally done by the banker. It basically means that if a cheque is marked as good by the banker, it will be honored whenever it is duly presented for payment. This practice is not established in India by any legislation or judicial precedents.

Edited by Shikhar Shrivastava

Approved & Published – Sakshi Raje

Reference

[1] British Bank of Middle East Vs. Almal Bros. (66 CWN 285)

[2] D. Kapoor (Sultan Chand & Sons)- Part three: Negotiable Instruments Act

[4] Negotiable Instruments Act, 1881